Unlock Your Financial Possible With Convenient Loan Solutions You Can Depend On

In the world of individual money, the accessibility of easy finance services can be a game-changer for people striving to open their economic capacity. When seeking monetary assistance, the dependability and reliability of the financing copyright are critical factors to consider. A myriad of lending alternatives exist, each with its very own collection of benefits and factors to consider. Comprehending exactly how to browse this landscape can make a considerable difference in achieving your monetary objectives. As we check out the world of problem-free lendings and trusted solutions further, we discover important understandings that can empower individuals to make enlightened decisions and safeguard a stable financial future.

Benefits of Hassle-Free Loans

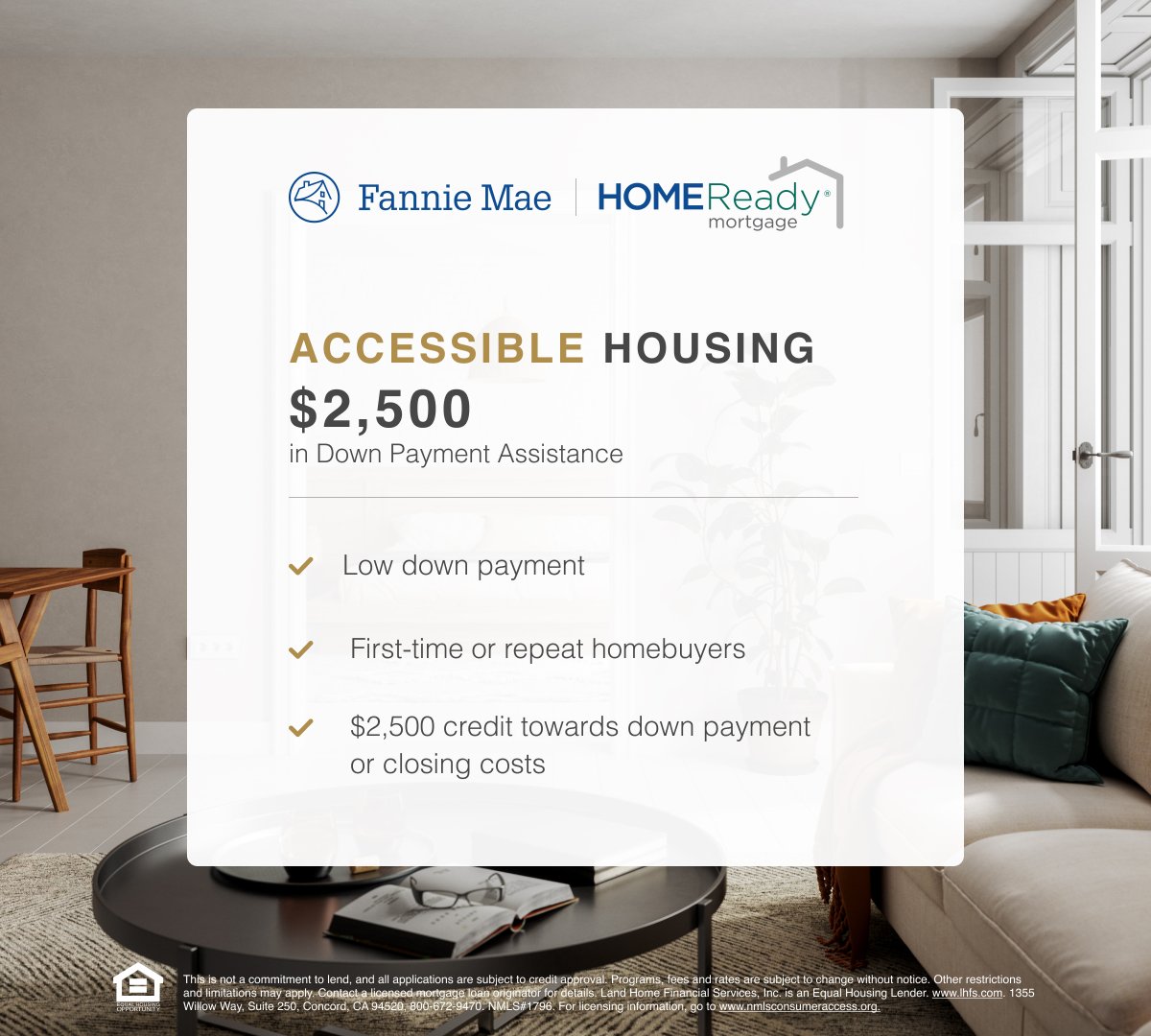

Convenient lendings use consumers a reliable and structured means to gain access to financial support without unneeded issues or hold-ups. In comparison, hassle-free financings prioritize rate and comfort, giving consumers with quick access to the money they need.

Additionally, problem-free car loans commonly have very little eligibility requirements, making them available to a more comprehensive series of individuals. Traditional lenders typically require extensive documentation, high credit rating, or security, which can exclude numerous potential consumers. Easy finances, on the other hand, concentrate on price and versatility, providing support to individuals that may not fulfill the rigid demands of typical banks.

Kinds Of Trustworthy Loan Solutions

Exactly How to Receive a Lending

Discovering the crucial qualification standards is vital for people seeking to qualify for a finance in today's financial landscape. Supplying precise and up-to-date monetary info, such as tax returns and financial institution declarations, is necessary when applying for a funding. By recognizing and satisfying these qualification criteria, people can enhance their opportunities of qualifying for a finance and accessing the economic help they need.

Taking Care Of Lending Repayments Carefully

When consumers successfully safeguard a lending by meeting the essential eligibility requirements, sensible management of financing payments becomes vital for preserving financial stability and creditworthiness. To manage finance payments sensibly, borrowers should create a budget plan that consists of the monthly repayment quantity. By handling car loan repayments properly, borrowers can not only accomplish their monetary obligations however also develop a positive credit report history that can profit them in future monetary ventures.

Tips for Selecting the Right Car Loan Option

Picking the most appropriate lending alternative entails comprehensive research and factor to consider of specific economic demands and scenarios. Consider the car loan's complete expense, payment terms, and any additional costs linked with the loan.

Furthermore, it's important to choose a car loan that straightens with your economic goals. By adhering to these tips, you can confidently pick the appropriate funding alternative that assists you accomplish your financial purposes.

Verdict

Finally, opening your economic possibility with easy funding solutions that you can rely on is a responsible and wise decision. By recognizing the benefits of these lendings, knowing how to get approved for them, taking care of repayments wisely, and picking the best lending option, Read More Here you can achieve your economic goals with self-confidence and comfort. Trustworthy loan solutions can give the support you require to take control of your financial resources and reach your preferred results.

Protected loans, such as home equity finances or auto title finances, permit consumers to use security to secure lower rate of interest rates, making them an appropriate option for people with useful assets.When customers successfully secure a lending by meeting the crucial qualification requirements, sensible management of car loan repayments becomes paramount for keeping financial stability and creditworthiness. By handling financing repayments sensibly, customers can not only accomplish their economic obligations but also develop a positive credit rating history that can benefit them in future economic undertakings.

Think about the funding's total expense, payment terms, and any kind of extra fees connected with this hyperlink the finance.

Comments on “Easy Loans Ontario: Simplified Approaches to Financial Backing”